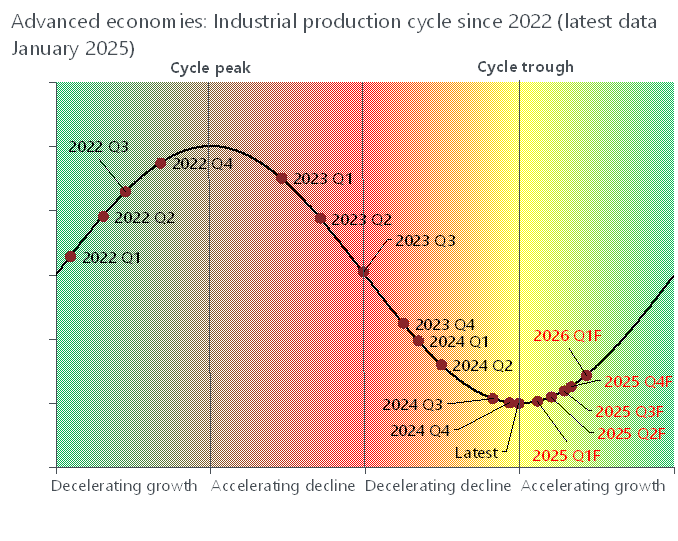

Oxford Economics’ Industrial Cycle Index for the advanced economies improved further to 1.1 in March, the second consecutive positive reading. While this is suggestive of a sustainable upturn, the eventual implementation of tariffs across a wider spectrum of countries and goods over the course of the year means that the industrial expansion will be slower to develop than we believed just a month ago.

For more economic insights and analysis of the industrial manufacturing sector: Manufacturing | Oxford Economics

Methodological note

The ICI places total industrial activity of the advanced economies (Western Europe, North America, Japan, and Australia/New Zealand) in a stylised business cycle based on two types of momentum in the monthly industrial production index: the sequential rate of change and whether that rate of change is accelerating or decelerating. The methodology encompasses official data for industrial production published by national statistical agencies (and hence can be subject to historical data revisions), as well as our nowcasting methodology.

The ICI ranges from -10 (the most intense period of contraction) to +10 (the most intense period of expansion), with changes of sign signalling turning points in the cycles.

In order to reduce noise in monthly data which can lead to false readings, we calculate these rates of change based on a smoothed 12-month moving average. Furthermore, we calculate sequential momentum as the monthly change in a three-month moving average of the smoothed industrial production index.

It is also important to note that because downturns are typically shorter than expansions, economies can move through the downcycle relatively quickly (though this is not always the case). For the same reason, industry may remain in the accelerating growth or decelerating growth phase for quite some time—being near the top of the cycle does not mean a downturn is imminent.